Okay, so you were so moved by the last lesson that you are sure you will not be successful timing the market and you’re sure there isn’t some investment expert or formula that can time the market either. Does this mean you are doomed as an investor?

Let’s look at some real world data.

This little bit was written for Charles Schwab, and I want to share it with you.

Imagine for a moment that you’ve just received a year-end bonus or income tax refund. You’re not sure whether to invest now or wait. After all, the market recently hit an all-time high. Now imagine that you face this kind of decision every year — sometimes in up markets, other times in downturns. Is there a good rule of thumb to follow?

Because timing the market perfectly is, well, about as likely as winning the lottery, the best strategy for most of us mere mortal investors is not to try to market-time at all.

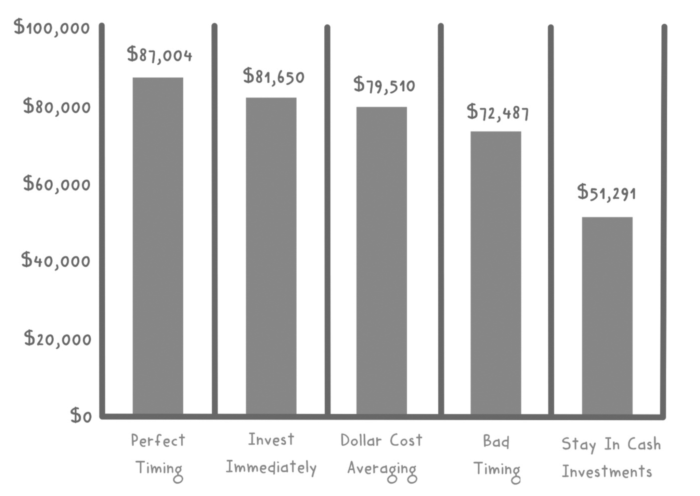

But don’t take my word for it. Consider Schwab’s research on the performance of five hypothetical long-term investors following very different investment strategies. Each received $2,000 at the beginning of every year for 20 years, ending in 2012, and left the money in the market.

Check out how they did:

- Peter Perfect was a perfect market timer. He had incredible skill (or luck) and was able to place his $2,000 into the market every year at the lowest monthly close. He continued to time his investments perfectly every year through 2012.

- Ashley Action took a simple, consistent approach: Each year, once she received her cash, she invested her $2,000 in the market at the earliest possible moment.

- Matthew Monthly divided his annual $2,000 allotment into 12 equal portions, which he invested at the beginning of each month.

- Rosie Rotten had incredibly poor timing, or perhaps terribly bad luck. She invested her $2,000 each year at the market’s peak.

- Larry Linger left his money in cash investments (using Treasury bills as a proxy) every year and never got around to investing in stocks at all. He was always convinced that lower stock prices, and, therefore, better opportunities to invest his money, were just around the corner.

Here are the winners:

What do you notice?

Well, the perfect market timer, the investor who bought precisely at the very best times over the last 20 years, did the best. But look at the others. Other than the guy who didn’t invest at all, they all did well. The takeaway is that you do not need to be extraordinary. You don’t need a crystal ball to get a good investment return. Remember, it’s not about timing the market; it’s time in the market.

If that’s the case, then why do so many people do so poorly? You’ll find out what they do so wrong in the next lesson.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.