We try to solve “the nastiest and hardest problem in finance."

William Sharpe, a Ph.D. economist at Stanford University and winner of the Nobel Prize in Economics, described spending down assets in retirement as “the nastiest, hardest problem in finance."

Why should we care what Dr. Sharpe has to say about retirement planning? He is one of the originators of the Capital Asset Pricing Model – basically the model investors use to measure risk and reward.

His comment surprised the investment and retirement planning community because there are dozens of challenging issues in finance. Nobody expected him to say the most significant problem and challenge is figuring out how best to draw income in retirement.

Why is creating a sustainable retirement income distribution plan in retirement so difficult?

Why do retirement financial planners spend so much of their focus on educating clients and creating income strategies in retirement? During the retirement planning process, Pacifica Wealth gets to know a lot about you as a client.

If Pacifica Wealth knows so much about our clients, why did Dr. Sharpe conclude retirement income planning to be the most challenging issue in all of finance?

Why is creating a sustainable retirement income distribution plan in retirement so difficult?

Why do retirement financial planners spend so much of their focus on educating clients and creating income strategies in retirement? During the retirement planning process, Pacifica Wealth gets to know a lot about you as a client.

If we know so much about our clients, why did Dr. Sharpe conclude retirement income planning to be the most challenging issue in all of finance?

The answer, in a word, is uncertainty.

To create a perfect retirement income plan you would need to be able to accurately predict several important variables in the future. But, of course, we don’t know what the future will hold. We can make informed decisions based on educated assumptions with the data we have today, but because the future is uncertain, we can’t know for sure if our decisions are optimal until we see the results of those decisions.

There are several significant questions that we can’t definitively answer when someone is ready to retire such as:

- How many years will you be retired?

- What average annual investment return will your portfolio produce?

- What is the sequence of investment returns that will produce the average annual return in #2?

- What will income and capital gains tax rates be in the future?

- Will there be large and unexpected expenses, and if so, what will they cost?

- What will the rate of inflation be each year in retirement?

- How much are your living expenses each year in retirement?

These are just a few issues that make creating a sustainable stream of income in retirement challenging. All of these factors (and others) go into determining how much you can safely pull from your retirement portfolio each year. Since all of these questions are unknowable, we can only make educated predictions for each of these.

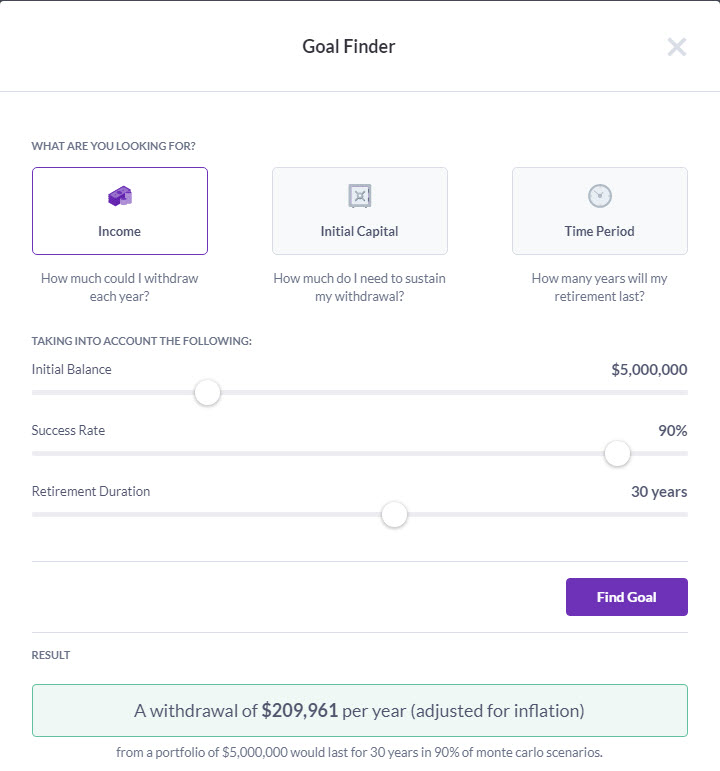

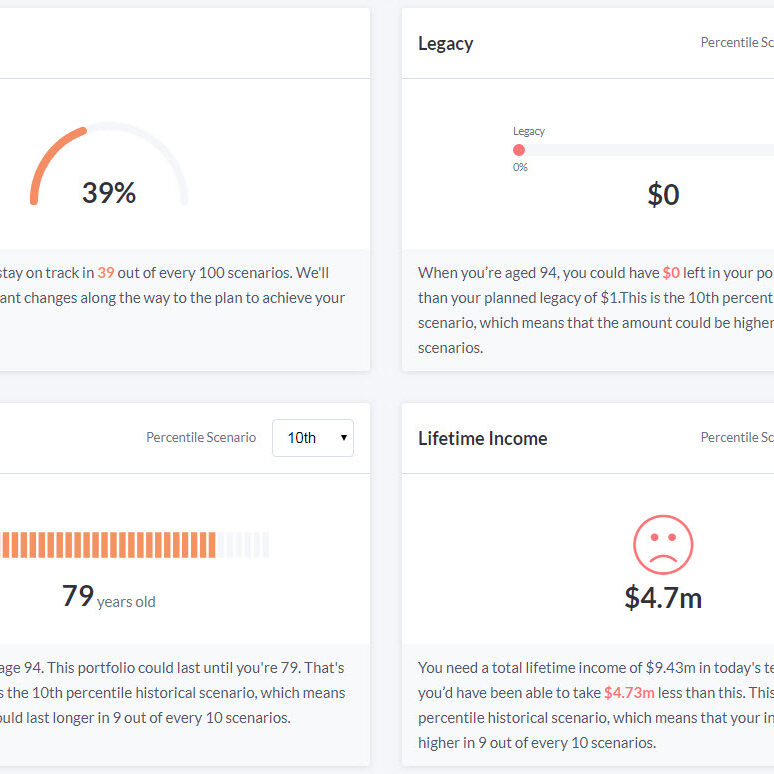

when working with a new retirement planning client we run a series of scenarios.

The first is often looking at what might happen if you did no planning and didn’t change anything. Sometimes your plan looks good, but sometimes it requires additional planning.

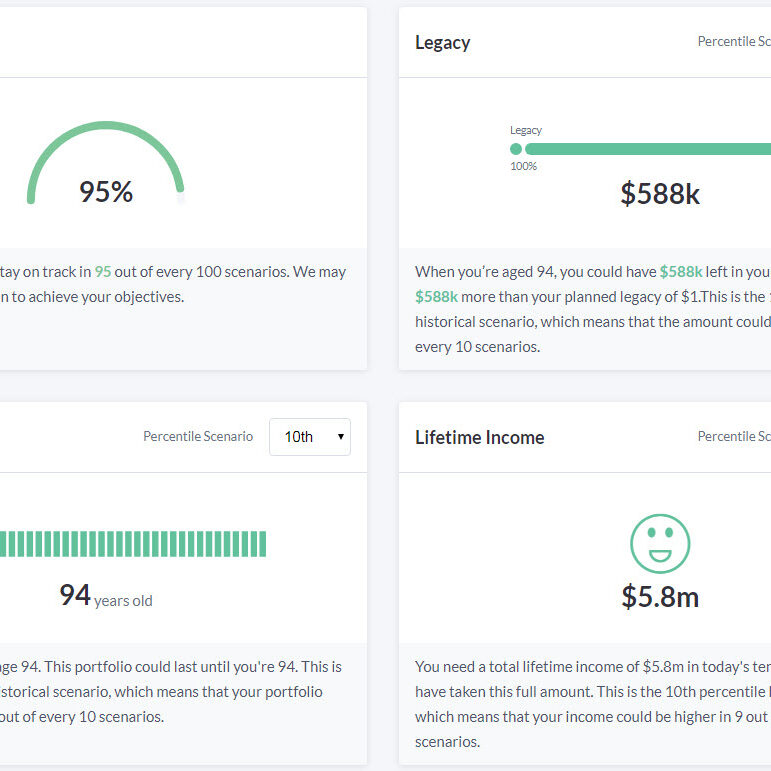

When your retirement plan looks unsustainable, we get to work on alternative scenarios and strategies. Our goal is to increase the success rate of the retirement plan and create confidence for you.

The goal is to work closely with you, discuss our assumptions, discuss trade-offs, and ultimately to create a lifetime source of income in retirement that provides you with security and a lifestyle you desire.

Pacifica Wealth use a series of sophisticated financial planning tools to help guide our understanding of the client’s situation and to help create a retirement income distribution plan you feel good about.

You’ve sacrificed, saved, and made smart decisions about investing.

Once you get to the point of considering retirement, you want to feel secure that there will be enough income to support you for decades. We can help you financially plan for your retirement with clarity.

Pacifica Wealth has spent nearly three decades helping clients retire successfully. Our lead retirement financial advisor, Robert Pagliarini, Ph.D., CFP® has a Ph.D. in financial and retirement planning and has dedicated his professional life to helping clients create lifetime income in retirement.