What’s Inflation?

When I was a kid, I had to walk to school in three feet of snow, in June, uphill both ways. Okay, so maybe Gramps is exaggerating just a bit, but when he complains about paying $15 for a movie or $10 for a hamburger because when he was growing up “movies were a nickel and hamburgers were a dime,” it may not be such an exaggeration.

If a movie really was a nickel 60 years ago (and by the way, they were), it begs the question why? Is it because movies today are so much better? A quick stop at your local Cineplex can help you answer this.

Why were movies, or hamburgers, or cars, or whatever so much less expensive? The short answer is inflation. The long answer is the rest of this lesson.

Let’s break this down.

Inflation sounds a lot like inflate, like inflating a balloon. And that’s exactly what’s happening. Inflation is when the cost of goods or services increases over time. That’s the what, but you still don’t know the why.

Why do prices go up?

There are lots of reasons, but I will discuss the main two:

Inflation Cause #1

Let’s say you have a protein-infused wheat grass stand (I mean, who’s buying lemonade anymore?). You charge $5 for a shot of the green sludge and you make pretty good money. Then one day there is a breaking news alert that protein-infused wheat grass cures cancer and heart disease. Suddenly there is a line around the block to buy your stuff. What do you do? Do you lower the price because you are generous and want to help your community? Of course not! You jack up the price to $7.50 a shot and you still sell out. What just happened? Lots of people wanted your product and they were happy to pay more for it. In economist speak, there was increased demand for your product, which enabled you to raise prices. This is one way we get inflation – demand grows faster than supply.

Inflation Cause #2

You’re making a killing with your protein-infused wheat grass stand. This catches the eye of a few more entrepreneurs who want to make a quick buck. They start buying protein and wheat grass by the carton and bushel. Every day you sell out so you place larger orders of the ingredients. Things are going fine until a big storm destroys 50% of the wheat grass farms. When you place your next order, you see that the cost of wheat grass has shot up by 100%. What do you do? You need the wheat grass, so you buy it. Now that you are paying so much more for the ingredients, you are making a lot less on every shot. So what’s a good capitalistic entrepreneur to do? Raise prices! This is the second way we get inflation. When a company’s costs go up, they tend to increase their prices to offset the extra expense. But if you’re a company, it doesn’t look good if you keep raising your prices. Understandably, it might upset a lot of your customers if you’re always jacking up the cost. This is where companies get tricky. Rather than raise the cost of a box of cereal, what if they just charged the same but gave you less? They wouldn’t dare . . . would they? Oh yes they would! It happens all the time across a variety of products. It’s not your imagination – there is more air and fewer chips in the bag, fewer sheets of paper towels, and as one reporter wrote, “Even smaller squares of toilet paper.”

You may have a couple of questions. Like, how much do things generally go up each year? Looking back over the past 100 years or so, it’s gone up, on average, a little over 3% per year. This means that if something costs $100 this year and there is inflation of 3%, that same thing might cost $103 the next year.

Is there a problem with inflation?

Yes and no. Economists say it is important and natural to have some level of inflation, but if you do the Money Smart thing and save your money, it loses its value each year. The $100 you save this year can’t buy as much next year or two years from now or 24 years from now. This is called the erosion of buying power and it’s why inflation is a wealth killer. It’s like carbon monoxide – silent, odorless, and invisible. Slowly and gradually your savings are worth less and less. That’s the bad news. The good news is there’s a solution! It’s called investing.

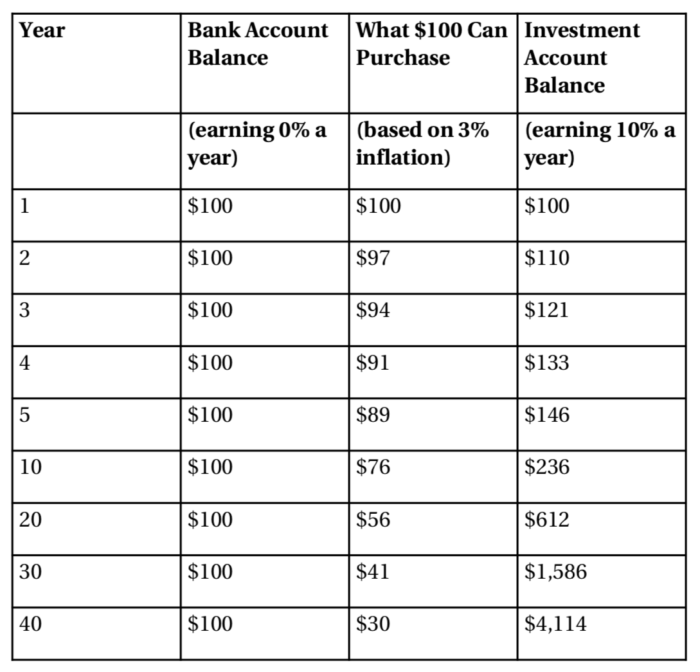

Here’s how it looks.

This is a hypothetical example that is demonstrating a mathematical principle. It does not illustrate any investment products and does not show past or future performance of any specific investment.

What’s the takeaway?

Inflation is a wealth killer, so you’re better off spending all of your savings right away! No, that’s not the takeaway. Inflation is a wealth killer, but fortunately there is a way for your money to not just “keep up” with inflation but actually grow faster than inflation. This is called investing and that’s what the next section of blog posts will be about.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.