How will you possibly handle the ups in the market?

This is kind of a trick question.

Those stressful days, weeks, and months where you look at your accounts and they just keep going up, and all you can think of is all the money you are making? How will you handle this? Therapy?

Of course, it’s not the ups that are really the problem. It’s the downs that can cause anxiety, sleepless nights, and fear.

But, I think you’ll be a better investor if you approach both the ups and the downs similarly. It’s about approaching the market and investing with a healthy perspective.

The investors who celebrate the ups and the highs are the same ones who suffer the most when the market is down.

It’s like that friend you have who is nuts about your local sports team. They go crazy when they are winning – they are on top of the world and nothing could be better. And then they go nearly comatose and depressed when their team is losing. And there are some people, you know who you are, who experience these high highs and low lows not just during the season, but during each game!

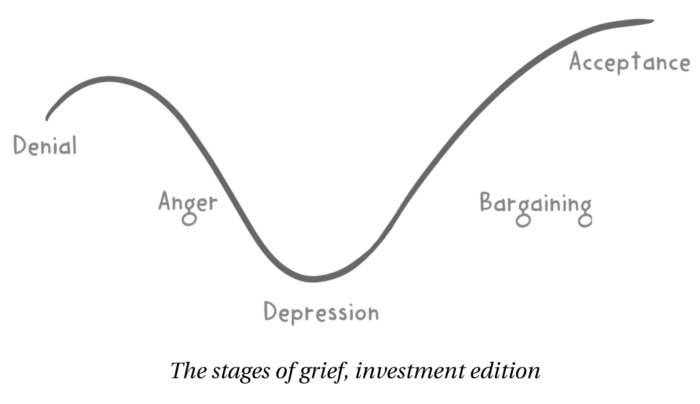

As an investor, this is a terrible existence. It will give you an ulcer, and it will drive you to drink. This kind of emotional involvement is not sustainable. You will crack, and that’s not pretty. What does cracking look like? Well, I suppose it could include lithium and white coats, but here’s what cracking normally looks like.

Think back to March of 2009, when our country was in the middle of a recession.

Markets plunged nearly 50% from their peaks. Unemployment was high. The banking and financial industries nearly collapsed. We were on the precipice. But we also had a government that was throwing nearly a trillion dollars at the problem. We still had companies who were selling goods. We still had people who were working. Things were bad, but it wasn’t the end times. Investors were discouraged, to say the least. They saw their portfolios drop by 25% or more.

Instead of telling you what cracking looks like, how about I tell you what it sounds like? “Get me out.” That’s the call many advisors received. Cracking is deciding that you just can’t stomach any more losses, despite having a reasonable allocation and long-term investment horizon, and selling everything and going to cash. Stop the bleeding is the phrase that comes to mind.

As an investor, you don’t invest for a quick buck.

You invest for years and you have to go in thinking that there will be losses at some point. Let me repeat that. I tell my clients over and over again, you will lose money! That’s not a commercial slogan or tagline you’ll often see: “Invest with us. We guarantee you’ll lose money.” But it’s true. As an investor, there will be periods of time when your account will go down.

It’s important to recognize this and to prepare mentally for it. This way, when it happens, and it will, it doesn’t take you by surprise.

But what’s the problem with just selling and going to cash once in a while after the market drops?

You can’t effectively sell and then buy at the right times. Remember, this is called market timing, and it’s how to become a millionaire – you start with a billion and then market time, and you’ll likely end up with a million. It just doesn’t work.

The clients who said, “Get me out!” in March 2009 got out at the low. From early March until now, the market has gone up 100%.

The takeaway?

Know your risk tolerance and put together a portfolio that matches the amount of risk you want to take. Expect that you will lose money. Really anticipate that it will happen. Imagine checking your portfolio online and seeing nothing but red. It will happen. Inoculate yourself. Lastly, don’t celebrate the ups and the highs. Take a more measured approach. The best approach is to think and truly believe that the market goes up and the market goes down. Over time, I expect that the value of my account will go up, but in the short-term, anything can and will happen.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.