As an investor, you’re bound to hear a lot about asset classes.

This is one of those key areas in which you’ll want some level of understanding. In other words, you would definitely not be money smart if you didn’t know about asset classes.

So let’s jump in.

An asset class is just a fancy phrase for investments that are similar to each other. This group of investments has similar characteristics and behaves in a similar way. As a comparison, think about all the different kinds of vehicles that are available. Everything from a Corvette and a Land Rover to a Harley motorcycle to a Prius. These are all very different, but could you start to categorize all of the vehicles into a few different groups? Sure you could. You could put the Corvette with the Porsche and the Ferrari. We’d label these sports cars. We could then group the Land Rover with the Ford Explorer and the Suburban. These would be SUVs. We’d group the minivans together. Maybe we’d put the luxury cars into their own group. You get the point. We started out with lots of different individual vehicles, but we could group them together into similar categories.

Asset classes are the same thing when it comes to investing.

There are four main groups, or asset classes, for investors. These are:

- Stocks

- Bonds

- Cash

- Real Estate.

Sure, there are investments that don’t neatly fit into these categories, but this encompasses most of what you’ll come across.

That’s it. Just stocks, bonds, cash, and real estate. We humans love to put things into boxes because it’s so helpful. If your friend texts you that he just bought a new SUV, you have a pretty good idea of what he has. Instead, if he says he just bought a new sports car, again, you can infer a lot from just knowing the category.

Just like you can tell a lot about the categories of cars, the same holds up with investment asset classes.

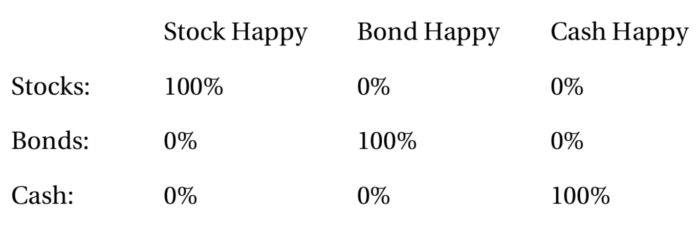

How is this helpful in the real world? Let’s look at a few different scenarios:

Now let’s say the stock market has a great year and goes up 25%. How is Stock Happy’s portfolio going to do? Awesome! Bond Happy? Okay. Cash Happy? Not very good.

Now let’s say the stock market has a bad year and goes down 25%. How is Stock Happy’s portfolio going to do? Lousy. Bond Happy? Good! Cash Happy? Great!

Even though you don’t know anything about the actual investments – the actual stocks that Stock Happy owned or the types of bonds that Bond Happy has – you can quickly and accurately tell how well they did in each of these scenarios.

This is why understanding asset classes is so important as an investor.

Are there other asset classes?

The short answer is yes. You can start with the four main asset classes: stocks, bonds, cash, and real estate, and then you can get even fancier by categorizing these into sub-asset classes, but that’s for another time.

Here’s a quiz for you.

What’s wrong with this statement: “My asset allocation is 60% mutual funds, 40% ETFs.” Come on. Make me proud.

Well, did you notice anything fishy about that statement? We know the main asset classes are stocks, bonds, cash, and real estate.

Is a mutual fund an asset class? Is an ETF an asset class? No! A mutual fund could be entirely invested in anything. All stocks. Or maybe all bonds. Your asset allocation is not mutual funds and ETFs. You would have to determine what your mutual funds and ETFs are invested in to really know what your asset allocation is.

It’s like saying, “I’m having a plate and a bowl for dinner.” Huh? Those are just the devices that hold your food. They are meaningless unless you know what’s in your bowl or on your plate. Does that make sense?

Okay. I need to take a break. All this talk of food and I’m starting to get hungry.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.