The Importance of a Balanced Life

In working with individuals and families from diverse backgrounds, I’ve discovered a universal truth. If you take time to step back from the details of your daily life and focus on the bigger picture, you will find that there is probably an area or two in your life that is going well—maybe your job, your marriage, or your relationship with your kids. Most people can usually find some satisfaction in their lives.

On the other hand, there is usually one area that causes dissatisfaction—maybe even frustration or anger. You may be able to pinpoint those areas that make you unhappy, or if you are like many people, you may not be able to clearly identify these troubled areas.

In an effort to advance in one area of our life, we often neglect another.

Marital problems can destroy a good career, just as career problems can derail a good marriage. By neglecting certain parts of our life, we allow these areas to infect the areas where we are satisfied. These problems have the potential to undermine our success and overall happiness in life.

Life Zones

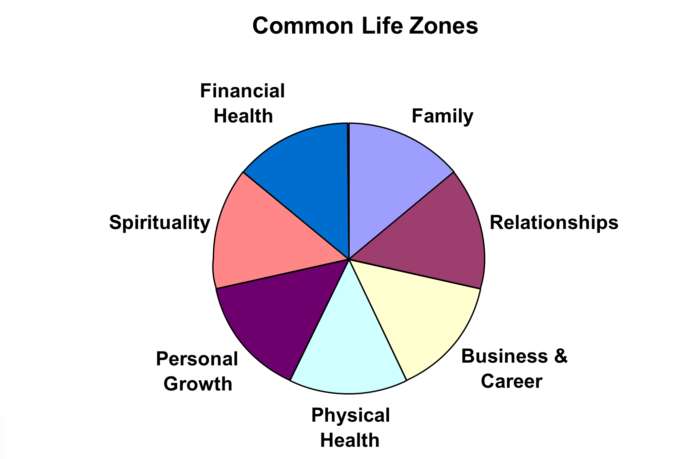

A balanced life is comprised of different Life Zones—the major areas of your life that are most meaningful and important to you. What I value may not be what you value—it is common for different people to have different Life Zones. The following represent the most common Life Zones for most people:

Improving Financial Health

This course focuses on improving one of the Life Zones—your financial health—and the importance of good financial health cannot be overemphasized. Like poor physical health, financial health can have an immediate and dramatic impact on the other parts of your life. Financial difficulties can split marriages, tear families apart, and can be a catalyst for health problems.

Financial problems may well be the number one cause of divorce and relationship break-ups.

Immediately following the terrorist attacks on September 11, 2001, twice as many adult Americans who had difficulty sleeping were worried more about their finances than about national security. Our nation was attacked. Thousands of innocent men, women, and children were murdered. Our sense of security was jeopardized, but we continued to worry about our finances. Few other things in life have the power of money.

Money is the fuel that propels you to your goals.

It is your ticket to the best schools, it provides the best healthcare, in short, money provides the opportunity to have the things you want, to accomplish your goals, and to grow as an individual.

“People who value money more than other goals are less satisfied with their income and with their lives as a whole.”

Make no mistake, money does not provide a guarantee that you will get what you want, accomplish what you desire, or become a better person. In fact, it is not necessary for you to have a lot of money to achieve success in life. Mother Teresa had very little financial wealth, but immense happiness and satisfaction with her life.

Remember—money is not evil, the love of money is. Dr. Martin Seligman writes in his insightful book Authentic Happiness, “People who value money more than other goals are less satisfied with their income and with their lives as a whole.” The pursuit of money is not unhealthy, the unrelenting pursuit of money at the expense of the other four elements of a balanced life is terribly unhealthy.

Sound financial health opens doors easily and quickly.

My wife and I tried for two years to get pregnant with no results. We sought the counsel of a fertility specialist and eventually adopted. Anyone who’s gone through fertility treatments and/or adopted knows it isn’t cheap! Without a clear understanding of our financial situation and the assets to pay for treatment (insurance doesn’t cover infertility or adoption), we may not have the beautiful girl we have today.

Another benefit of working on your financial health is that you have total control over it.

When you make improvements in other areas of your life the results are often slow to see. When you improve your finances, results can be visible immediately. Once you make a commitment to improve, your past decisions and behaviors are irrelevant.

Once our mind is open we can focus with precision on what we want to own, what we want to accomplish, and who we want to be. Hang on tight because we’re just getting started.

The proceeding blog post is an excerpt from The Six-Day Financial Makeover: Transform Your Financial Life in Less Than a Week!, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.