Not as complicated as it sounds

There might be a few new words you will not be familiar with in this lesson, but trust me when I say you’ll want to know what these mean. And sadly, many investors aren’t even sure what they mean, but you will!

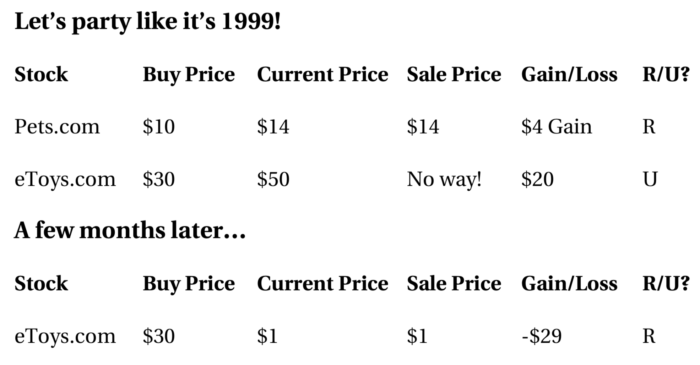

Take a look at the charts above.

- In the last column, the “R” stands for “realized.” Realized means you have sold and you have locked in whatever gain or loss you have. Realized means you have really either made or lost money.

- The “U” in the last column stands for “unrealized.” Unrealized means you haven’t sold yet, but if you did right now, this is what your gain or loss would be. Unrealized means you are still unsure when you are going to sell.

Who cares?

Well, there may be some tax consequences that we’ll talk about in a future lesson, but what’s important here is that once you sell, you have locked in, or realized, your gain or loss.

When you sold the share of Pets.com for $14, you had $14 in your pocket. You could then take that $14 and buy the new Christina Aguilera single, Genie in a Bottle. Once you sold your share of Pets.com, you didn’t care that the stock went from a high of $14 down to zip, zilch, zero. Didn’t affect you because you sold and were Livin’ La Vida Loca with Ricky Martin.

With an unrealized gain or loss, you still own the investment.

You do care what happens because you still own it. As you saw with your share of eToys.com, you had an unrealized gain of $20, but you got greedy and didn’t sell. Then a few months later, the stock plummeted and you eventually sold for $1 a share. You turned your unrealized gain you had into a realized loss. When you sell, you either realize a gain or loss. In this case, you bought eToys.com for $30 and sold it for $1, so you had a realized . . . loss. That’s right.

Quick story.

Back in 1999, I get a call from a friend of mine. He’s screaming in the phone, “I’m a millionaire, I’m a millionaire!” He tells me the internet company he works for gave him some stock in the company and the stock price was shooting up. He also said the company wouldn’t let him sell it for six months. So, his stock really was worth millions. He had an unrealized gain. Unfortunately, like many internet stocks at the time, his company’s stock dropped. When he could sell it, the stock was basically worthless. He went from having a million-dollar unrealized gain to having nothing. Some people refer to unrealized gains as paper gains. Why paper gains? Because you get your statement in the mail and on the statement it shows this big gain, but until you actually sell, the gain doesn’t really mean anything.

Pop quiz.

If I haven’t sold an investment, is it realized or unrealized? It would be unrealized. As soon as you sell it, then it becomes realized. Is it a gain or a loss? That’s easy. If you’re selling it for more than what you bought it for, it’s a gain. If you are selling it for less than you bought it for, it’s a loss.

There it is. Realized and unrealized gains and losses. We like both realized and unrealized gains, but we don’t actually have the money in our pocket until we convert those unrealized gains into realized gains when we sell, which is something I hope you do a lot of as an investor.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.