I’m an advocate of living within your means. I don’t believe in borrowing or using credit cards to fund a lifestyle that my income can’t support. If you live a lifestyle beyond your means for too long, you dig an increasingly larger financial hole. What should you do if the life you want is above…

Read MoreMaybe the idea of a Six Day Financial Makeover was attractive to you because you are in debt. How can you think about saving to reach your goals when you are plagued with overwhelming credit card debt? It will take discipline and hard work, but you will be able to pay off your debt and…

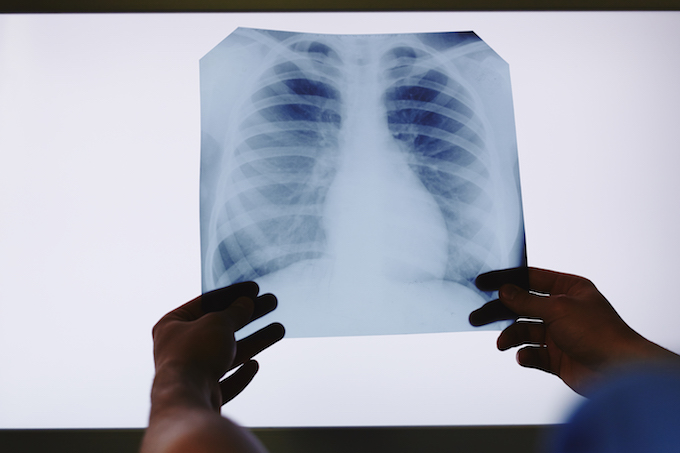

Read MoreWhile the advice to spend less than you make isn’t new, you will learn how to see your expenses in a new way. You are going to X-Ray your cash-flow to look for hidden opportunities. What does this mean? It means you are going to take a close look at each expense to determine if…

Read MoreThe Optimized Spending Pyramid Before you analyze your expenses and goals and develop a personalized cash-flow plan, let’s look at a Spending Pyramid. A Spending Pyramid represents the order and how income is allocated. A common Spending Pyramid of an average individual or family might look like this: Common Spending Pyramid You will…

Read MoreWhen it comes to finances and cash-flow, are you swimming, treading water, or sinking? Choose the letter that best describes where you are today: I use a credit card but always pay off the balance every month. A. That’s exactly right. B. Most of the time I do but there are months where I can’t.…

Read MoreNow that you’ve got a handle on your current financial health, it’s time to focus on what you’re doing daily to improve or damage your financial health. Getting control of your finances wouldn’t be complete without understanding your personal cash-flow. Cash-flow is a fancy phrase that means the money coming into and out of your…

Read MoreYou entire financial health can be summed up with one number. This one number reflects all of the financial decisions you’ve ever made. That number is your net worth. For such a powerful number, you would expect a long and complicated calculation; however, it is easy to calculate your net worth. Large well-known companies such…

Read MoreThere are few things as important to your long-term financial success as your ability to take control of your finances. But what does it mean to “take control of your finances?” It means having a purpose and a strategy for how you spend money. Most of us tend to “go with the flow.” While this…

Read MoreSeeking the Quick Fix When I was in high school, I’d lift weights twice a day, drink protein concoctions three or four times a day, and try just about anything to build muscle faster (only natural supplements of course, no steroids!). My mother worked at a local health food store, so I had plenty of…

Read MoreWhat does it take to become financially successful? Is there a proven formula that will provide us the solution? If you look at those who are financially successful — not just the big wig Fortune 500 executives and celebrities, but normal people (remember Aimee?) — you will find they share one thing. It’s not a…

Read More