Are you financially independent?

Now that you know what financial independence is and why it is important, it is just as important to understand what it is not. Financial independence is not about being “rich.” To be rich, you only need to make or have a lot of money. This definition ignores a critical part of the equation—expenses.

Financial independence involves earning enough passive income to support the kind of lifestyle you desire.

As a result, there is no “magic” amount of passive income that is required—it is entirely dependent on your expenses. If you earn $100,000 in annual passive income and have expenses of $85,000 per year, you are financially independent. If you have $500,000 in annual passive income but have $750,000 in expenses per year, you are not financially independent. Expenses are an equally important part of the equation.

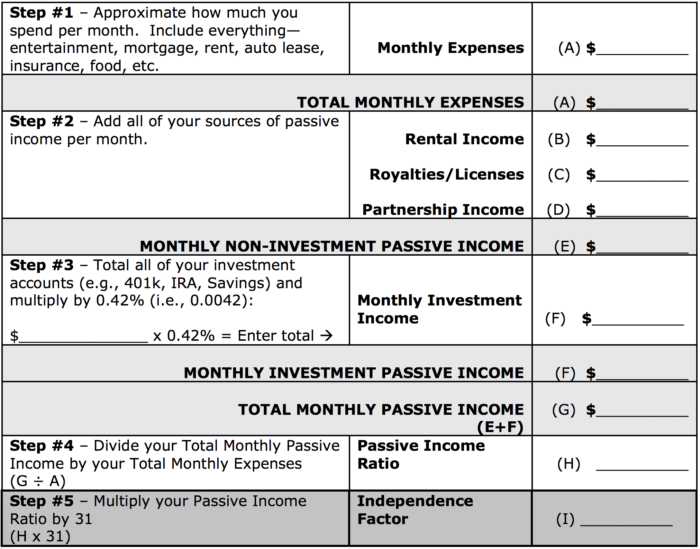

Determine Your Independence Factor: The Financial Independence Quiz

Scoring the Financial Independence Quiz

Your Independence Factor represents the number of days per month you could survive with your current lifestyle without working. In other words, if you stopped working tomorrow, your Independence Factor tells you how many days you could live off of your passive income. If your goal is to have the freedom and flexibility of financial independence, you need to make sure you have enough passive income to last you through the whole month.

- Daily Factor 0 – 7 = A score in this range means that if you stopped working tomorrow, the income you generate from your passive investments wouldn’t cover you for more than a week every month. Life would be good for those first few days. You could sit back, spend time with the family, maybe enjoy a round of golf. But before you know it, your passive income would run out. What would you eat the rest of the month? Where would you live? Don’t worry if you fall into this category. It just means you need to increase your passive income, reduce your expenses, or both. You have some work to do, but the good news is that you will quickly see results from your Financial Makeover.

- Daily Factor 8 – 23 = Keep up the good work—you’re not quite there but the goal is in your sights. By controlling your expenses, setting up automatic savings plans, and investing with a purpose, you will be able to last two weeks a month, then three, then the entire month.

- Daily Factor 24 – 30 = You’re well on your way to becoming financially independent. By saving a little more and investing wisely, you will soon experience the joy of financial independence.

- Daily Factor 31+ = Congratulations! You are financially independent. If you stopped earning a paycheck you’d be just fine. You’d be able to pay your mortgage, your gas bill, and still have money left over for food and entertainment. You could pay for all of this from the passive income you generate—month after month, year after year.

How can you increase your independence factor?

If your Independence Factor isn’t quite as high as you’d like, don’t worry, you’ve come to the right place. Lessons in the blog posts that follow will provide you with step-by-step instructions and guidance to help you increase your Independence Factor!

The proceeding blog post is an excerpt from The Six-Day Financial Makeover: Transform Your Financial Life in Less Than a Week!, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.