The Optimized Spending Pyramid

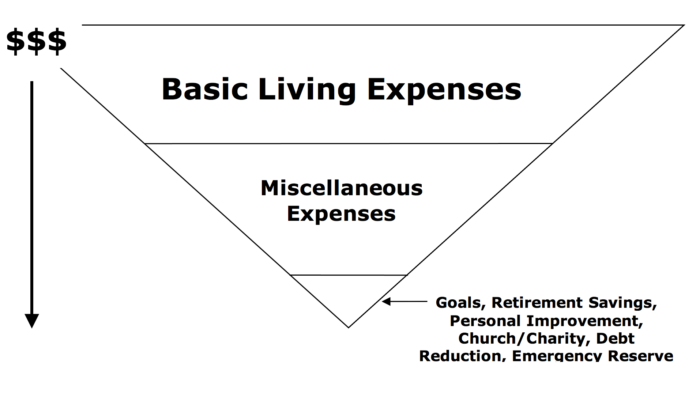

Before you analyze your expenses and goals and develop a personalized cash-flow plan, let’s look at a Spending Pyramid. A Spending Pyramid represents the order and how income is allocated. A common Spending Pyramid of an average individual or family might look like this:

Common Spending Pyramid

You will notice most of the income is being spent on Basic Living Expenses (e.g., rent, mortgage, food, transportation, utilities, etc.) and Miscellaneous Expenses (e.g., minimum credit card payments, entertainment, dining out, etc.). Only a small amount—usually what is left over—is used for retirement savings, goal achievement, debt reduction, charity, and establishing an emergency reserve account. Based on this fairly common spending pattern, it is easy to see the financial damage that can develop over time.

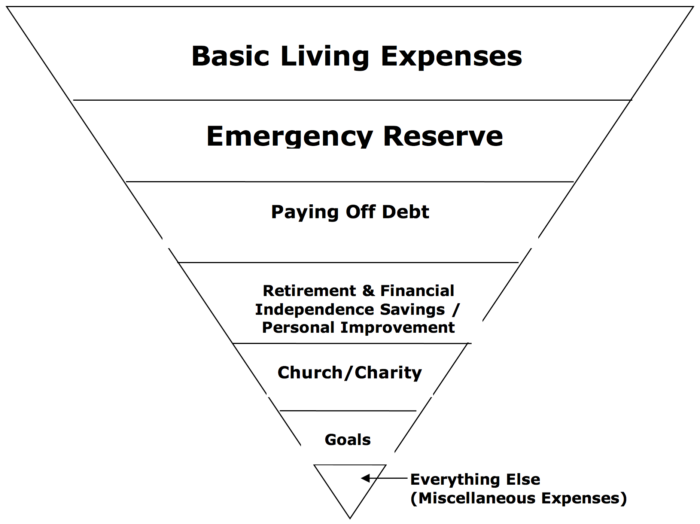

A more optimized Spending Pyramid would look like this:

Optimized Spending Pyramid

For the average individual or family, the expenses that top the Spending Pyramid should be funded first and will most likely account for the majority of your income. Each layer of the Spending Pyramid should be funded from top to bottom. The bottom of the Spending Pyramid represents the expenses/goals that should be funded last and with whatever money is left over after funding the expenses/goals above it.

The Optimized Spending Pyramid has seven layers:

1) Basic Living Expenses

These include expenses such as rent or mortgage, food, clothing, insurance, daycare, medication, car loans, school loans, and transportation costs and will probably take up most of your income.

2) Emergency Reserve

Your emergency reserve is your financial cushion in case something goes wrong and you lose your job or you need access to money quickly. Your emergency reserve should consist of at least three months worth of cash. Once you’ve saved enough for the cushion, you can move down to the other expenses/goals.

3) Paying off Debt

Consumer debt such as credit card balances is like an anchor that weighs you down. Paying down this kind of debt is critical for long-term financial health. Once you have an emergency reserve, you should absolutely do what you can to reduce it as quickly as possible, which means you should allocate more of your income to this layer than to the layers below it. Non-credit card debt such as your home mortgage, school loans, and car loans do not have to be paid in full before you can start saving for other items farther down on the Spending Pyramid. The regularly scheduled payments are included above in the “Basic Living Expenses” category.

4) Retirement & Financial Independence Savings / Personal Improvement

Each of these categories are investments. Saving for retirement and saving to increase your Independence Factor are actual investments of dollars and cents. On the other hand, personal improvement is an investment in you. Personal improvement expenses include such things as college tuition, books, and gym membership. Retirement and financial independence savings as well as personal improvement are extremely important for your future success and happiness.

5) Charity

I strongly believe that we should give regularly to charity including your church or religious institution if applicable. There are numerous financial and psychological benefits we receive when we give.

6) Goals

If your goals are like most people’s goals, they require money or could be enhanced with money. If you are not actively and regularly saving for your goals you will not reach them, period.

7) Everything Else

This includes entertainment, dining out, and your Netflix account.

Of course, everyone’s situation is unique, and you might not agree with the order of priorities suggested by the pyramid.

For example, the two most common objections to the Spending Pyramid are:

“You want me to contribute to church/charity before I spend money on entertainment?”

Yes. There are a lot of truly good causes that need our attention and money. Even if it’s only a few dollars, I think it’s our obligation and a privilege to help those who are less fortunate or to advance an important cause. You also get three bonuses when you contribute to church/charity . . . a nice tax break, your children learn the importance of giving from an early age, and it just feels good.

“I’d rather save for my kids’ college education than save for retirement.”

While this impulse is understandable and certainly noble, I don’t think this is a good idea. In a perfect world, you’d be able to pay for your children’s college education and have enough for a successful retirement, and if you have that luxury—congratulations! If you determine that you can’t fund both, you must choose to save for retirement. Here’s why. If you can’t pay 100% of your children’s college expenses it doesn’t mean they won’t go to college. There are a lot of alternatives such as student loans, financial aid, and scholarships. If you haven’t saved enough for retirement, you won’t have any options. They don’t hand out scholarships or grants to pay for retirement. Take care of your retirement first. Your children will thank you.

Now that you have a good idea of what an optimized spending pyramid should look like, we’re going to continue understanding your cash-flow with an expense x-ray, coming up in next week’s lesson. Stay tuned!

The proceeding blog post is an excerpt from The Six-Day Financial Makeover: Transform Your Financial Life in Less Than a Week!, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.