Stocks have been the focus over the past couple of months. When you hear about the “market,” they are referring to the stock market. When they discuss that the “futures are up” or the “futures are down,” they are talking about stocks. Everybody wants to talk about stocks, but there is another type of investment that is also very important and that makes up a large percentage of your portfolio that rarely gets a mention — bonds. Why?

Stocks are exciting. They make big moves both up and down (sometimes even in the same day!). And bonds? They are typically much more subdued. If you were a Brady Bunch fan, “Marcia, Marcia, Marcia” may come to mind. Yes, bonds are the Jan Brady of the investment world. But don’t take their lack of headlines to mean they are not important or are always safe. In fact, not all bonds are created equally. This last quarter is a prime example of that.

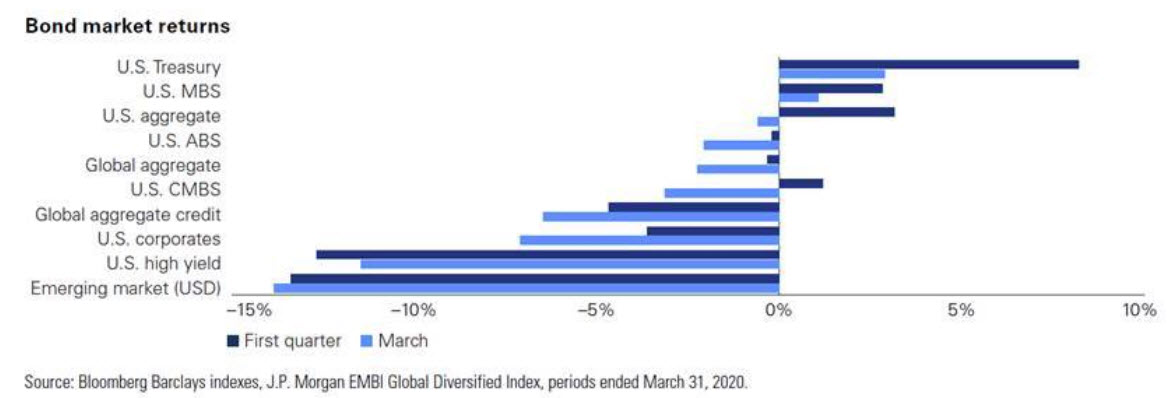

Have a look at the graphic below:

You will see these are different types of bonds. What do you notice? A HUGE difference in their performance over a three month period! Emerging market bonds and high yield bonds were down almost 15%. Yes, these are bonds and they were down almost 15% in just a three month period. And you thought bonds were boring. Corporate bonds were down over 6% in just the month of March. At the same time, U.S. Treasury bonds were up about 4% for the quarter. What’s going on?

What’s going on is that not all bonds are the same. Although stocks are known to be volatile, bonds – especially certain kinds of bonds – can be just as volatile. How does this affect your portfolio?

I view bonds as a source of income and as a ballast in a storm. I want my bonds to zig when stocks zag – to offer some protection and to minimize the overall volatility of a portfolio. The last thing I want is to think I have a diversified portfolio of “safe” bonds and stocks only to discover that my bonds were down 15% in a month!

The bonds we use in our client portfolios have held up well. Why? We don’t generally invest in emerging market bond or high yield bond funds. Although these types of bonds may provide a slightly higher yield, with that extra yield comes a great deal of risk. My philosophy is that if you want to take risk with your bonds you might as well just buy stocks instead.

Additionally, late last year and in January we shifted almost entirely out of corporate bonds and into U.S. Treasury bonds. Again, this was done as a result of our philosophy to keep our bond investments conservative – since that is the point (at least in our eyes) of what bonds are designed for.

In summary, not all bonds are boring or stable. Fortunately, our bond funds have held up very well and have performed exactly how we want them to perform.

About the Retirement Financial Advisor

Robert Pagliarini, PhD, CFP® is passionate about helping retirees build the retirement of their dreams. He has nearly three decades of experience as a retirement financial advisor and holds a Ph.D. in retirement planning. In addition, he is a CFP® Ambassador, one of only 50 in the country, and a fiduciary. His focus is on how to help make retirement portfolios last decades while providing a steady source of income. When he's not helping people plan their retirement, he might be traveling or writing his latest book. If you would like a second opinion to see if your retirement financial plan will keep you comfortable and secure, contact Robert today.