The following is a guest post by James Liu, CFA, Founder and Head of Research at Clearnomics

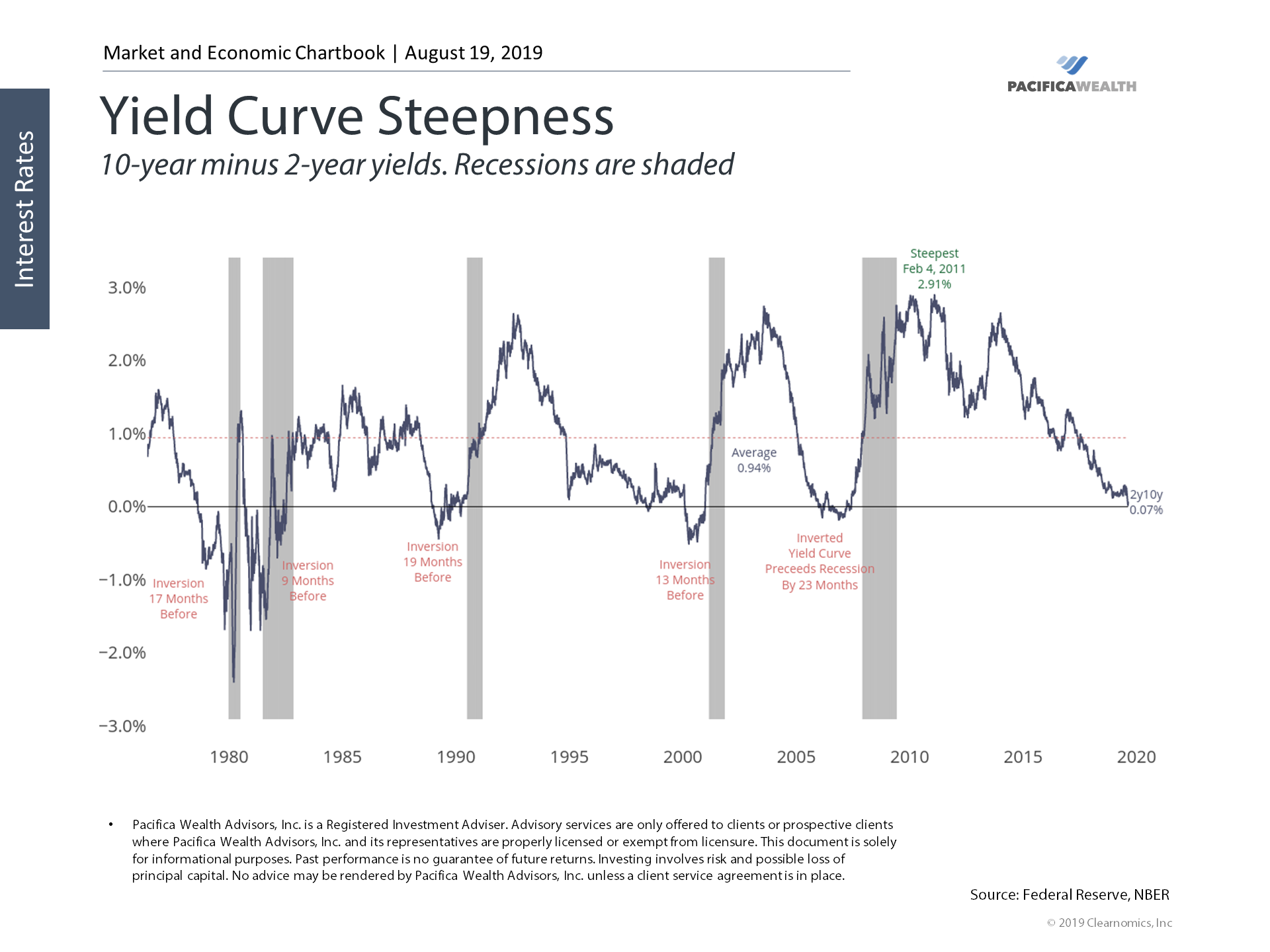

Of the market and economic indicators that predict recessions, none is as important as the steepness of the yield curve. It’s for this reason that markets reacted with uncertainty to last week’s intra-day yield curve inversion – the first since 2007. What does this mean for long-term investors and what’s different this time?

Although much ink has already been spilled on this topic, it’s an important one for investors to understand. The reality is that not much has changed for long-term investors over the past two weeks. The yield curve has been flattening for several years and the possibility of a recession is always a question of when, not if.

Thus, it’s never been about the exact timing of the next recession or market pullback. Instead, it’s about being positioned properly throughout these events. Investors should continue to focus on economic fundamentals and stay properly diversified across all phases of the market cycle.

Why is this the case? The yield curve can be an abstract concept but interpreting it is as an economic indicator is simple. In plain English, the “shape” of the yield curve tells us about the health of the economy and where we are in the business cycle. Traditionally, economists and market professionals look at the difference between 10-year and 2-year Treasury yields. Since we often plot these yields on a graph, when the difference is large, we say that the yield curve is “steep.” When it’s small, we say that the yield curve is “flat.”

Typically, the yield curve is very steep at the beginning of a business cycle. This is because the Fed keeps short-term interest rates low during economic downturns to stimulate the economy. As growth picks up, long-term rates begin to rise, which steepens the yield curve.

As the economic cycle matures, eventually short-term rates are high due to Fed rate hikes, while longer-term rates begin to rise more slowly or even decline. Thus, the shape of the yield curve can give us hints as to how far along the cycle may be. Today, the yield curve has been flattening for some time, suggesting that we have been approaching the later stages of the business cycle.

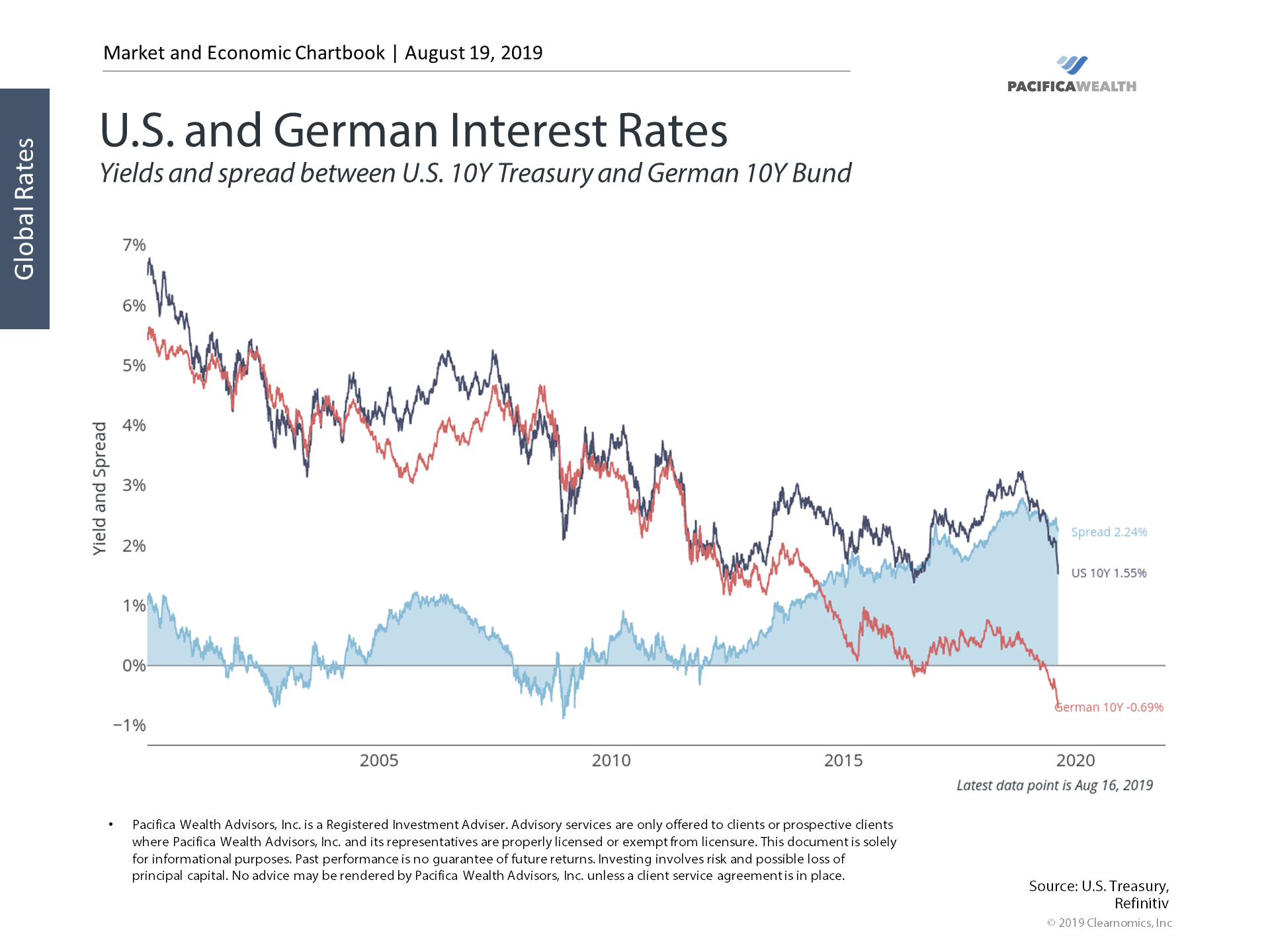

In addition to the business cycle, other factors can affect the yield curve which muddies the signal. First, global interest rates have been extremely low over the past ten years and have dragged U.S. interest rates down. At the moment, the entire German yield curve is in negative territory. This means that all German government bond yields are below zero – i.e. you’re guaranteed to lose money by holding these bonds to maturity. This makes U.S. Treasuries more attractive, raising their prices and pushing down their yields.

Second, while yield curve inversions may predict eventual economic downturns, they don’t tell us about the exact timing of recessions. For example, the yield curve flattened significantly in the mid-1990s, remained flat for a few years, inverted for a period in 1998, then re-steepened. The bull market then continued for another couple of years before the early-2000’s recession.

Third, there is no universally agreed-upon definition of the start of a yield curve inversion. Different economists and market professionals can quibble about which interest rates matter most. Additionally, does a brief intra-day inversion count? Or does it need to be sustained for some length of time? Each episode has its own unique circumstances which can only be judged in hindsight.

Thus, the goal of any long-term investor is still to stay balanced throughout all phases of the market cycle, and not to focus on day-to-day changes in market and economic indicators. A recession is likely to be inevitable – but trying to predict its exact timing is difficult if not impossible.

In fact, history shows that markets can perform quite well even after a yield curve inversion, confounding those who try to time the market. Staying balanced and invested is still the best approach to navigating this new phase of the market.

Below are three charts that provide perspective on recent events and highlight the impact on long-term investing.

1. The yield curve briefly inverted

The yield curve inverted briefly last week. This is the culmination of a process that has been occurring for the last several years, and will continue to do so as the business cycle evolves.

While yield curve inversions do precede recessions, they do not predict their exact timing. Over the past 50 years, recessions have occurred anywhere from 9 to 23 months after the 10-year Treasury yield falls below the 2-year – a large variation in timeframes. Additionally, there are other factors that could affect the yield curve this time around.

2. Low global interest rates are dragging down U.S. rates

International interest rates have remained low throughout this business cycle. One example is that of German government bonds – all of which now have negative yields. This means that holding these bonds to maturity guarantees a loss for investors.

This makes positive yields in the U.S. that much more attractive, which pushes them down further. The spread between U.S., German, and international bond yields has only continued to widen this year.

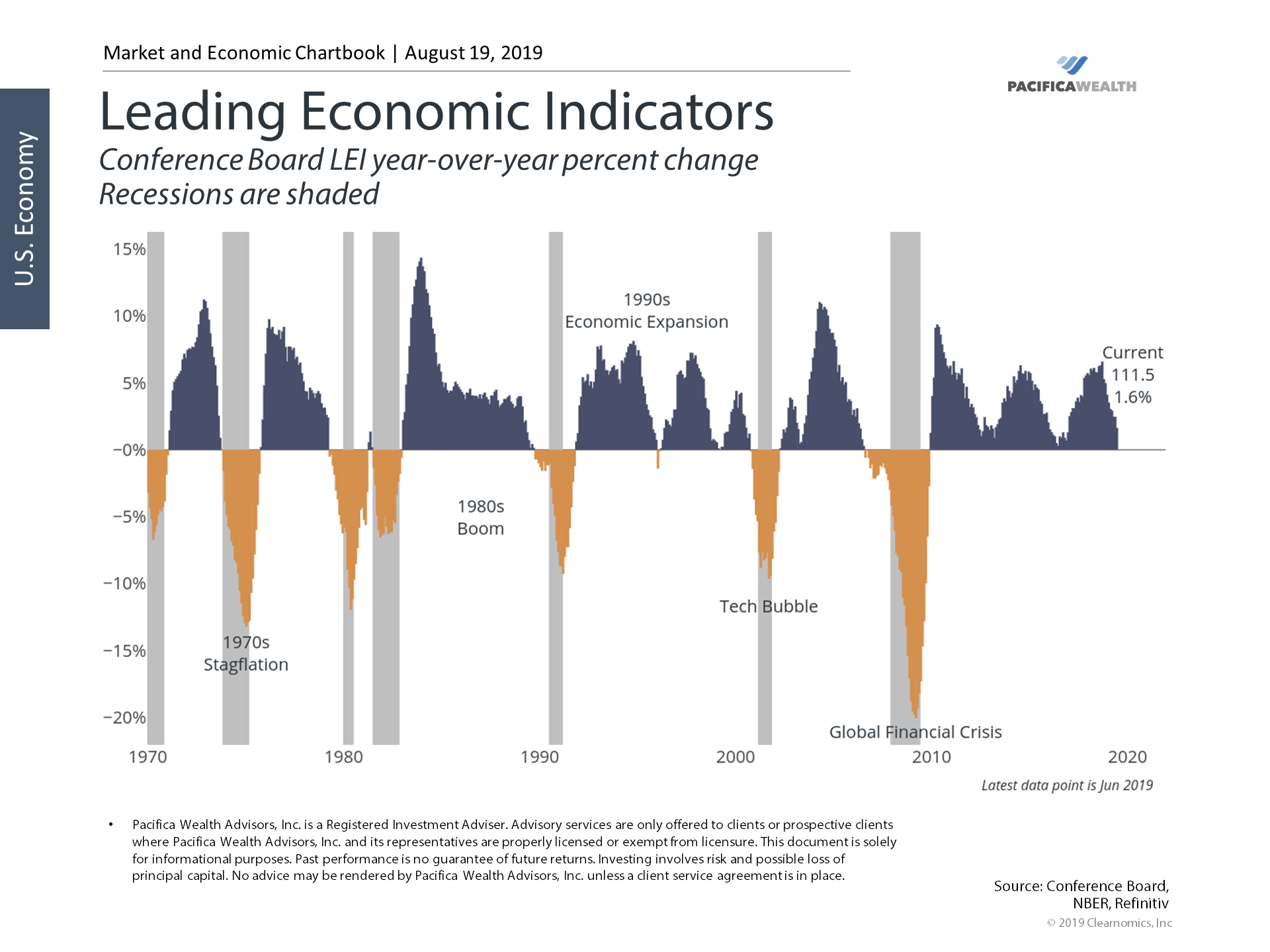

3. The yield curve is consistent with other economic indicators

Ultimately, the yield curve is consistent with many other economic measures. The index of leading economic indicators shown in the chart above also suggest that the economy is healthy but slowing.

Similar to the yield curve, these indicators also show that the end of a cycle is a process that takes time. Not only do the leading economic indicators typically roll over completely, but are often in negative territory for a period before the true onset of a recession. These indicators suggest that we’re not there just yet.

The bottom line for investors? Yield curve inversions are important signals for economists and investors. However, it’s important to remember that this is a process, not an overnight event. Long-term investors should stay diversified across all phases of the market cycle.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.