The global stock market has declined in recent days as markets focus on the spread of coronavirus in China and around the world. And while the human toll of this epidemic should not be downplayed or overlooked, it is perhaps the short-term panic in financial markets that have been more contagious. In times like these, it’s important for investors to maintain perspective and distinguish between how we react to world events in our everyday lives and how we respond in our financial lives.

In our everyday lives, it makes sense to heed expert advice on travel restrictions and take basic, sensible precautions. Additionally, while it’s important to stay well-informed, it’s just as important to listen to true experts and not those spreading misinformation or even fear. For a few, building and hiding in a bunker may be a tempting knee-jerk reaction, but this is likely to be an unnecessary overreaction.

The same is true in our financial lives. When it comes to our investment portfolios, it often takes real discipline to avoid short-term panic. Investors today are bombarded by influential sources such as the financial media, pundits focused on short-term trading and even friends and colleagues who may feel that the sky is falling. It can be difficult to distinguish between appropriate investment advice and knee-jerk reactions driven by market fear and panic. It’s understandable that in these situations, some investors may be tempted to sell well-planned investments and seek safety.

If history has taught us anything, however, it’s that the most basic precaution for many investors is simply to make sure that they have properly diversified portfolios. An appropriate portfolio not only has the right mix of stocks, bonds and other asset classes to weather all market conditions but is also tailored to an investor’s financial goals. Of course, this is often easier said than done. Fortunately, those investors who receive appropriate financial guidance are most likely already prepared for market conditions such as the current one.

What is the current market environment exactly? At the moment, the U.S. stock market has pulled back nearly 8% from its recent all-time high which it reached only a week ago. Year-to-date, the S&P 500 has fallen by 3.2%. Global markets have also swung into the red, with the MSCI Emerging Markets index and the MSCI Developed Markets index falling 5% and 6% year-to-date, respectively. Globally speaking, the MSCI All Country World Index is down about 4% this year.

It’s important to keep all of this in perspective. While global markets are negative two months into the new year, they are still quite positive on a year-over-year basis. Despite this recent decline, the S&P 500 has gained 14% with dividends over the past twelve months.

More importantly, short-term market pullbacks of this magnitude occur all the time. It’s not unusual for the market to decline 5, 10 or 15% on a short-term basis. Historically, many market corrections reverse in a matter of months, and those few that do become full-fledged bear markets do so because of recessions, extreme valuations or major policy blunders by the Fed. Regardless of how one feels about the current market and business cycles, recent market swings most likely have little to do with these factors.

Of course, no one can say for sure how much worse the spread of the new coronavirus will be, whether this could eventually induce a recession, or how the stock market will react next. However, this uncertainty is always present with market-moving events that dominate news headlines.

It was impossible last year to predict when the U.S.-China trade war would stabilize or how the market would react to Fed tightening in 2018. This was also the case during the Eurozone crisis of the early 2010s, the downgrade of the U.S.’s credit rating in 2011, the Fed announcing an end to quantitative easing in 2013, Russia invading Ukraine in 2014, slowing Chinese growth sparking a market correction in 2015, the volatility preceding the 2016 presidential election, recurring reports of North Korean missile launches, and countless other episodes over the past decade alone.

The entire history of the market involves investors climbing the so-called “wall of worry,” even when the worries seem insurmountable. So, while the coronavirus is of a different category than the concerns above, and may even be hard to compare to prior SARS and Ebola episodes, it has had the same effect on investor psychology.

For investors, having the fortitude to stick to well-considered asset allocation, especially when others are fearful, is often rewarded. In the end, investors should focus not on short-term gains and losses but on achieving their investment objectives and financial goals.

Below are five charts that help to put recent market movements in perspective.

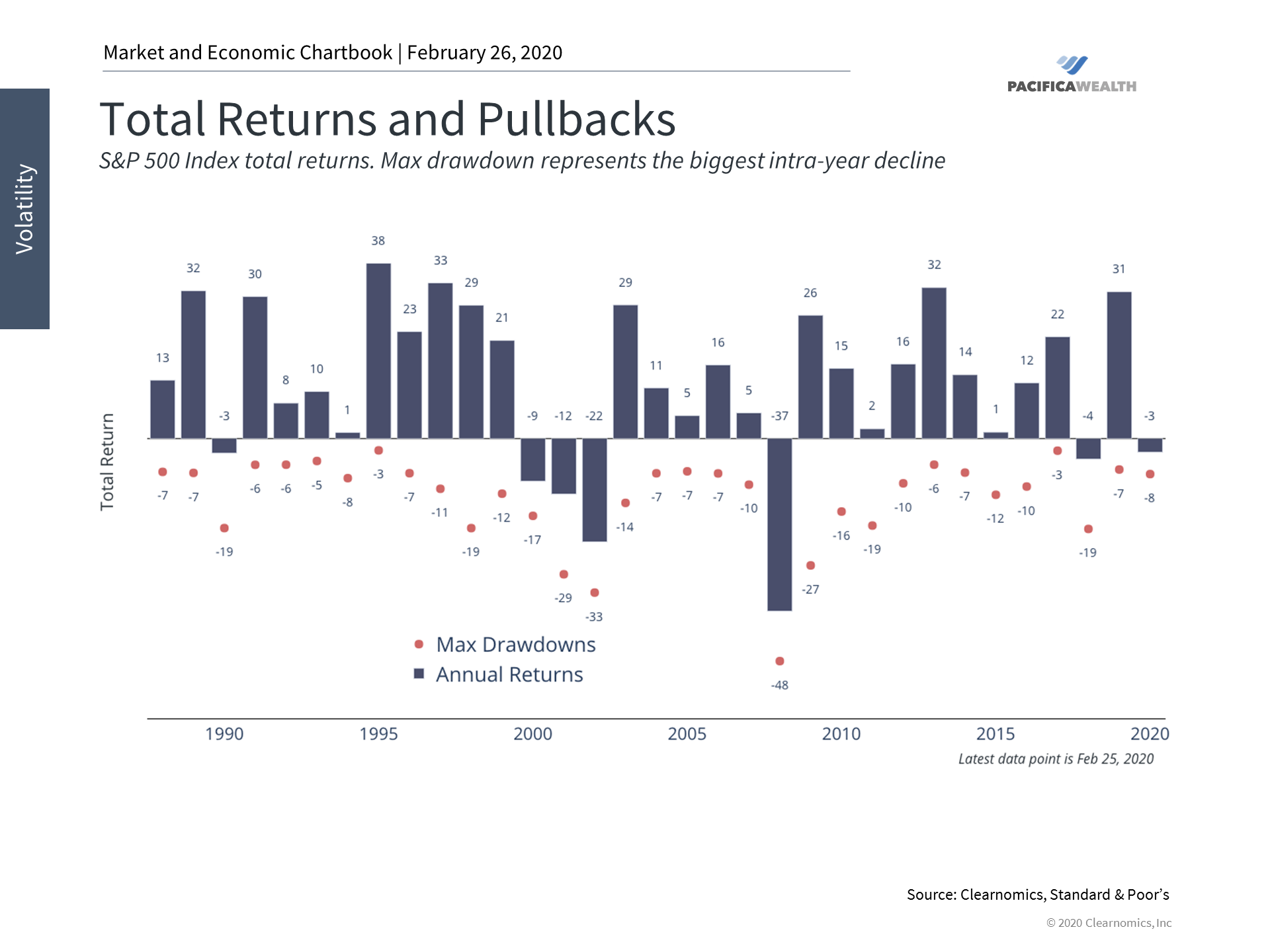

1. Short-term stock market swings are normal and expected

Total Returns and Pullbacks

Stock market pullbacks occur each year on a regular basis, although the past year has been relatively calm. Historically, the average intra-year decline is nearly 15%. This is true even though the market ends up in positive territory most years. Thus, it’s important to stay invested when markets are volatile and to keep the size of the market decline in perspective.

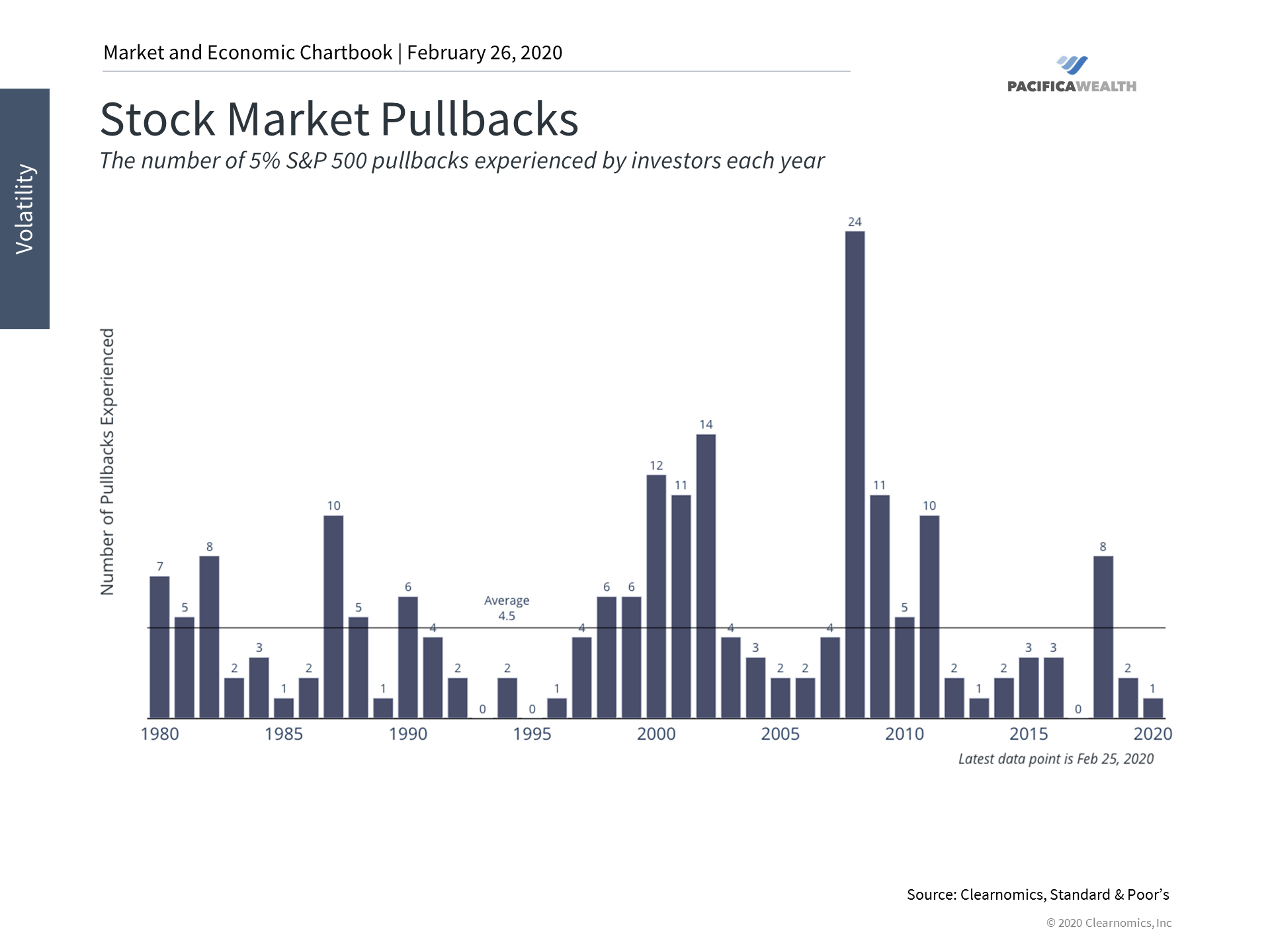

2. Several market pullbacks occur almost every year

5% Pullbacks

It’s also not unusual for stock market declines that are 5% or worse to occur many times a year. Even a year like 2019, when markets were fairly calm, experienced multiple pullbacks. Those investors who focus too much on daily, weekly or monthly market moves are likely to overreact when these events do occur.

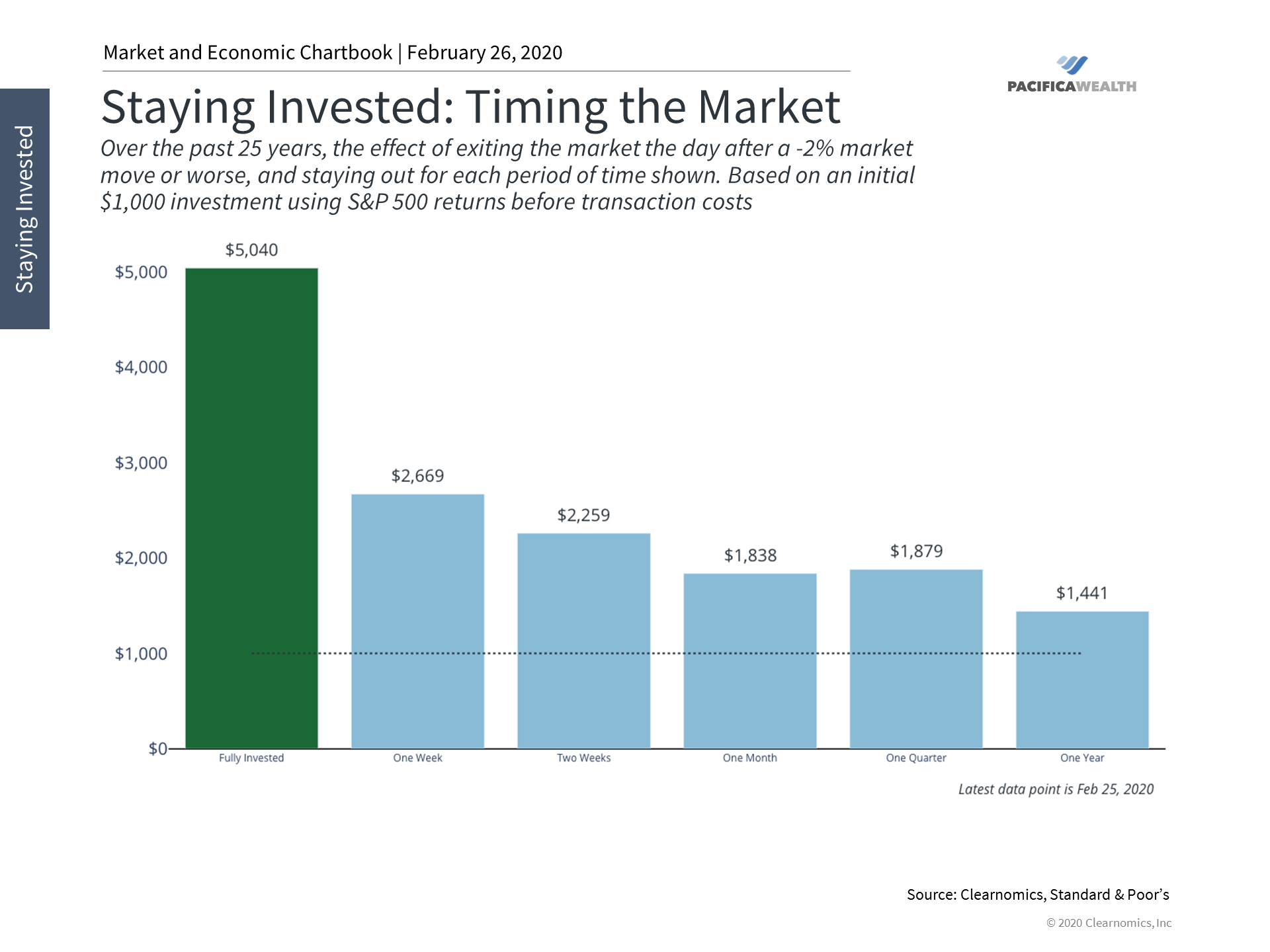

3. Trying to time the markets is often counterproductive

Market Timing – 25 Years

If there’s anything that over half a century of market research tells us, it’s that trying to time the markets is not only difficult – it may well be impossible. Historically, investors who overreact to large short-term moves in the market, often by trying to sell stocks, miss the subsequent recoveries and suffer worse average returns.

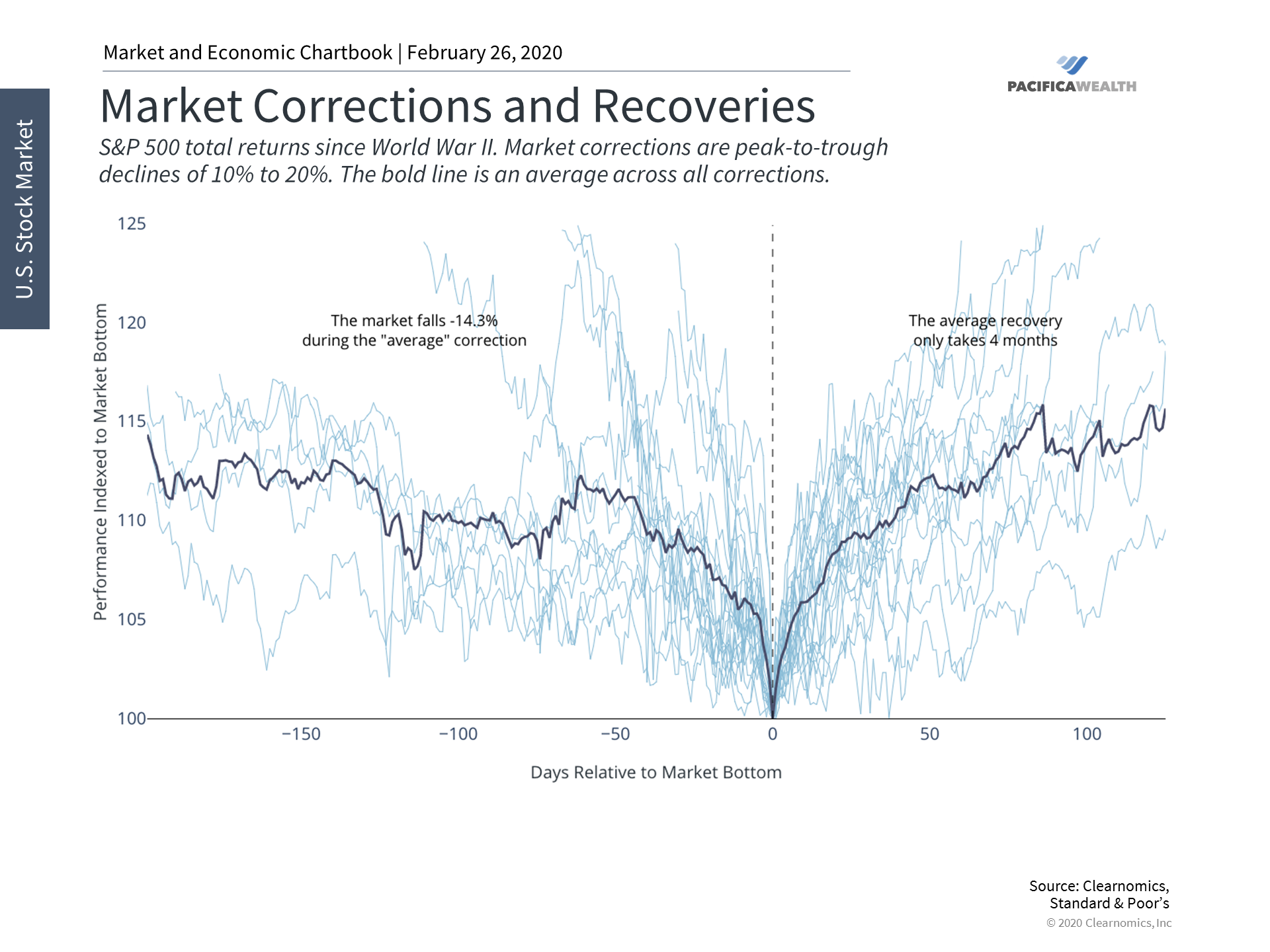

4. Market corrections often recover within months

Market Corrections and Recoveries

The term “market correction” is often used to characterize market declines that are between 10 and 20%. While every market correction has distinct underlying reasons, the average market correction recovers within months. This is especially the case if the underlying economy is still healthy and corporate profits are growing.

5. Having a long-term perspective is important

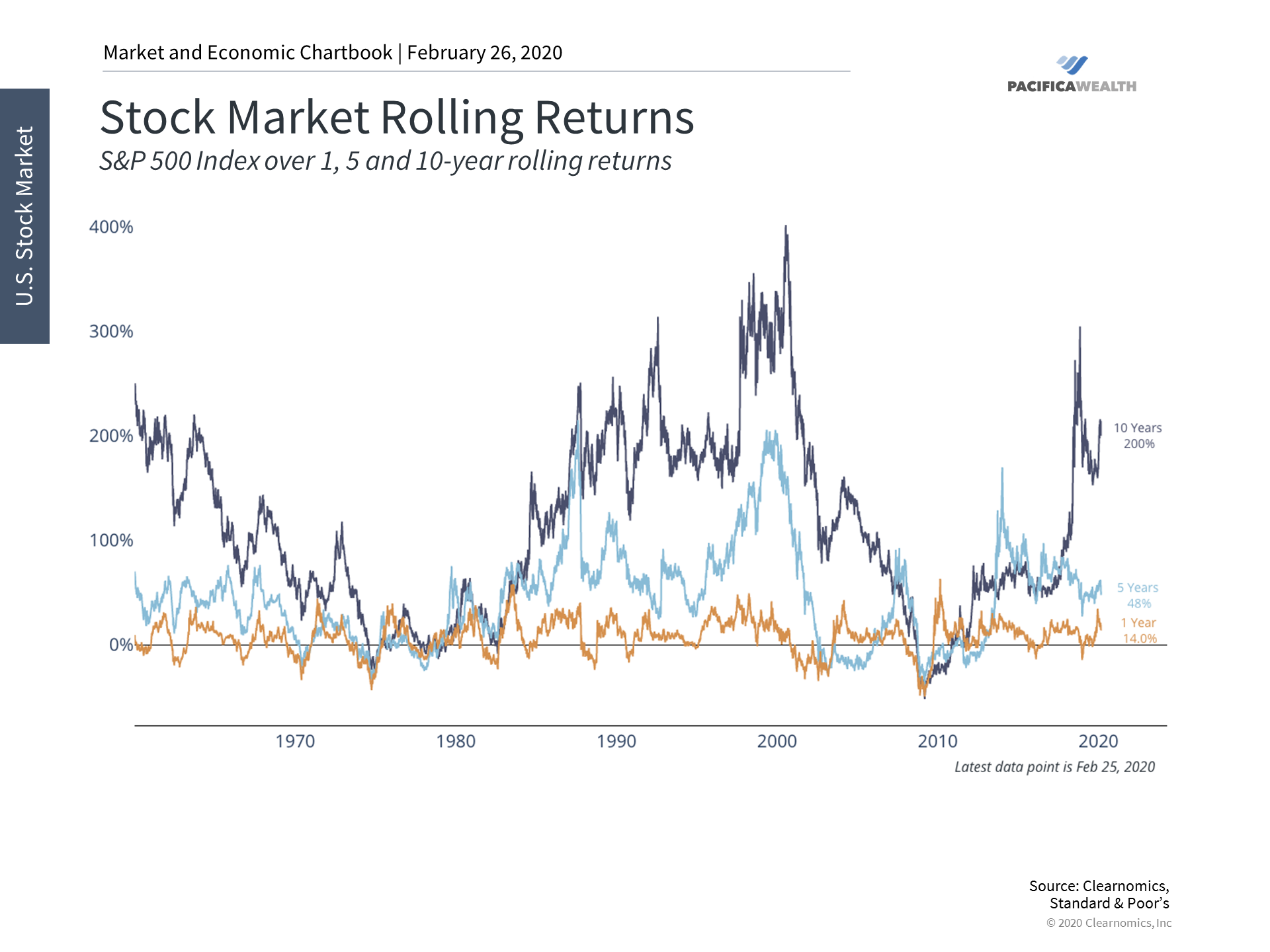

Stock Market Rolling Returns

Achieving financial goals is a long-term proposition. In the short run, stock market returns can fluctuate wildly between gains and losses. Over the long run, however, gains are not only more likely but are of a much larger magnitude due to the effect of compound returns. This is yet another reason to maintain a long-run perspective, rather than focusing on recent events and attempting to time the markets.

The bottom line? It’s unclear when the new coronavirus will be contained. What is clear, however, is that market swings are normal and expected. Investors should hold appropriate portfolios that anticipate periods of market volatility while still focusing on achieving their long-term goals.

The preceding is a guest post by James Liu, CFA, Founder and Head of Research at Clearnomics.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.